Welcome, fellow travelers, to the quirky intersection of stamps and economics! Prepare to embark on a journey where supply, demand, and a dash of whimsy collide in the fascinating realm of philatelic finance. From rare treasures to unexpected investments, let’s explore the strange but true tales of stamponomics.

1. The Priceless Rarity: Million-Dollar Stamps

In the world of stamps, rarity reigns supreme. And when it comes to rare stamps, some are worth their weight in gold (or even more!). From the legendary British Guiana 1c Magenta to the iconic Treskilling Yellow, these tiny squares fetch mind-boggling prices at auction houses around the globe. Who knew a small piece of paper could be worth millions?

2. The Boom and Bust of Stamp Speculation

Stamp speculation: it’s like the stock market, but with fewer numbers and more colorful pictures. Throughout history, stamp markets have experienced their fair share of booms and busts, with collectors and investors alike riding the rollercoaster of philatelic finance. From tulip mania-esque frenzies to sobering crashes, the world of stamp speculation is a wild ride for those brave enough to venture into its colorful depths.

3. Postal Pyramids: The Stamp Investment Scheme

Picture this: You receive an enticing offer to invest in a surefire money-making scheme involving stamps. All you have to do is buy a bundle of rare stamps, sit back, and watch your investment grow, right? Wrong! Stamp investment schemes have a checkered history, with some turning out to be little more than elaborate Ponzi schemes. Remember, if it sounds too good to be true, it probably is—even in the world of philatelic finance.

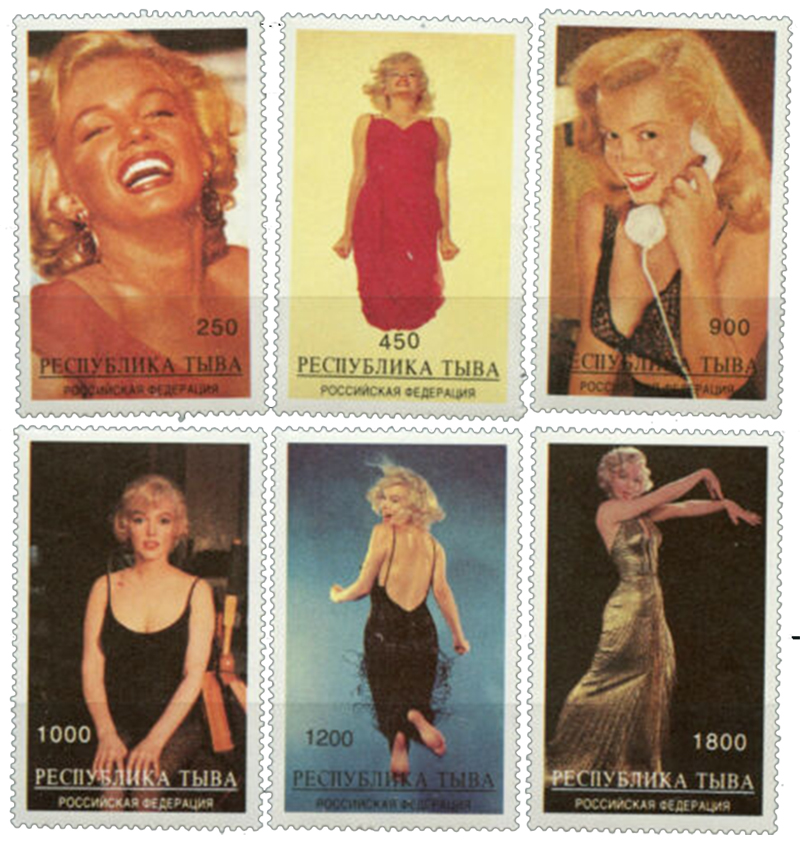

4. The Quirky Economics of Stamp Errors

Ah, the beloved stamp error: the bane of postal workers and the boon of collectors everywhere. From upside-down prints to missing colors, stamp errors add a dash of whimsy to the world of philately. But what happens when these quirky mistakes hit the market? Suddenly, a stamp that would have been destined for obscurity becomes a coveted treasure, fetching prices far beyond its original value. Who knew a little oops could be so lucrative?

5. Stamponomics 101: Investing in Quirkiness

In a world dominated by stocks and bonds, stamps offer a refreshingly quirky alternative for investors looking to diversify their portfolios. Sure, they may not provide the same returns as traditional investments, but stamps offer something money can’t buy: a sense of history, a touch of whimsy, and a colorful window into the world. Plus, they make for great conversation starters at cocktail parties!

So, whether you’re a seasoned stamp investor or just a curious observer of the weird and wonderful world of philatelic finance, remember this: in the world of stamps, economics isn’t just about dollars and cents—it’s about the stories, the quirks, and the joy of collecting something truly unique. Stamponomics: where finance meets fun!

Leave a Reply